Should we be relaxed about government debt? Spending and borrowing have risen astronomically in response to Covid-19, but governments seem less afraid of debt than in the past.

Fear as the Magic Money Tree keeps on giving

Should we be relaxed about government debt? Spending and borrowing have risen astronomically in response to Covid-19, but governments seem less afraid of debt than in the past.

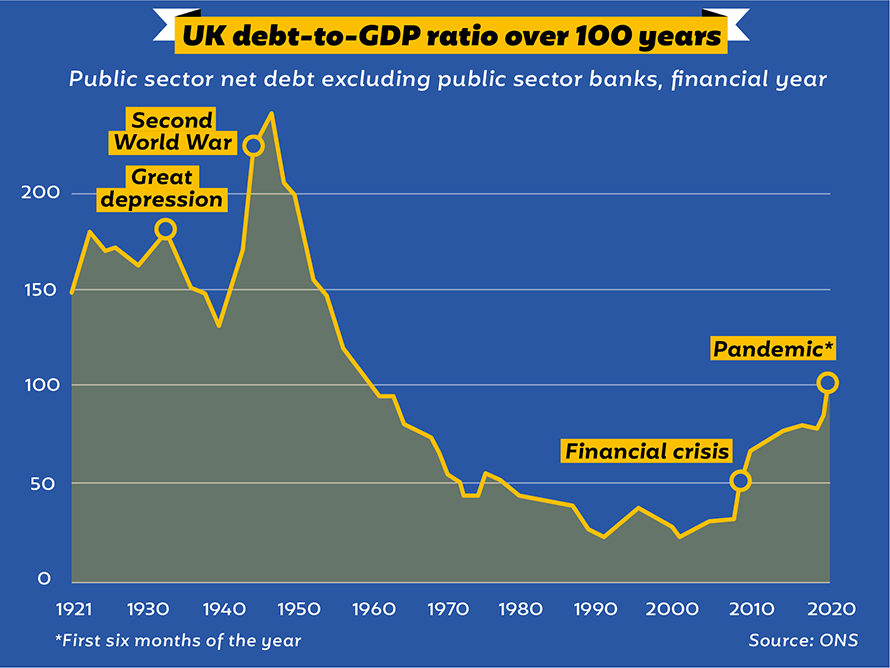

UK government debt now exceeds the total value of every product and service produced in Britain last year. Does it matter?

Facing the Covid-19 crisis, chancellor Rishi Sunak has had to reach for the Magic Money TreeThis was a phrase used by then Prime Minister Theresa May in 2017 to describe the Labour Party's more liberal attitude to public spending. May was likely alluding to a kind of Chinese good luck charm, a decorative tree associated with fortune., also known as government borrowing.

Policies such as the furloughThis used to be a word for a permitted absence, and refers to the scheme where the government subsidised the wages of those who could not work during the lockdown. The cost of the scheme is estimated at almost 40bn. system, and a declining tax-take have seen the budget deficitThe debt is the total amount of money that the government owes, but the deficit is the difference between how much the government spends and how much it earns. rise to 246bn in the last six months. For the previousn fiscal yearThis is the accounting year of the government. Fiscal, in this and other contexts refers to tax and spending policies., the entire deficit stood at 60bn. Debt is now at 103% ofn GDP.

The UK is not alone in its debt-funded spending spree. Global government debt now equals total global GDP. Indeed, Britain is set to have the second lowest debt-to-GDP ratio of the G7A group made up of six of the world's major industrialised nations/advanced economies (Canada, France, Germany, Italy, Japan, the UK) plus the EU. All of its current members are democracies. countries, after Germany.

The US congress has already passed a $2tn stimulus package and is haggling over another. If Joe Biden becomes President, he has promised to spend a further $7tn to boost the economy. Compared to this, the $800bn spent by Barack Obama after the 2008 recession seems positively tight-fisted.

For some, this spending is common sense. Then IMFThe international Monetary Fund. Its main function has been to manage debt difficulties in many countries, often enforcing strict financial discipline in exchange for loans to governments., which has traditionally been strict about government deficits, has argued for more public spending worldwide, not less.

After all, in spite of the rise in indebtedness, the cost of borrowing has gone down.

This is because government bonds, sold to fund debt, provide a safe haven for investors, particularly in countries like the UK or the USA, which can issue bonds in their own currency.

UK bonds, called giltsBritish government bonds have a gilded (gold) edge, and gilts is short for gilt-edged securities., have a yield of less than one per cent, but that is better than a loss for investors.

Some economists, advocates of what is called Modern Monetary Theory, go further, and argue that there is little need ever to worry about government debt.

Provided there is demand in the economy, they say, the government can create money, essentially from nothing. This is what happened with quantitative easing after the 2008 recession, where governments printed money to buy back their debt.

Others worry that rising debts mean rising interest rates, as happened in Greece in 2009. Beyond Europe, both Argentina and Lebanon are currently facing a debt crisis.

Part of the problem these countries face is because their debt is in a currency they do not control. Even if they did control the currency however, printing money raises fears of inflation.

This is where prices go up to reflect a perceived decline in the value of money. If everyone has more money, increasing demand, while supply does not increase, prices rise.

Inflation in developed countries has been low in recent years, however. So some see far more room for government debt before they start to worry about currency devaluation, or the other arguable downside of government spending, then crowding outThe theory that government spending crowds out investment operates on the basic principle that government debt increases interest rates, which makes it more costly for private businesses to borrow and invest. Ironically, it was the creation of government bond systems that first created the infrastructure for loans on the kind of terms now found acceptable to private business. of private investment.

As the theories diverge, the debt continues to mount in practice. Last year in a lecture, the former chief economist of the IMF argued that "Public debt may have no fiscal cost", we are likely to find out how true that statement is in the coming years.

So should we be relaxed about government debt

Yes we should, say some. Government spending helps to create demand and cuts could actually make the total debt problem worse, if the economy grows more slowly. Government debt is what created the stability that allowed the modern credit system to emerge in the seventeenth century. It is not like household debt; it is a necessary part of the modern world system, now more than ever.

No we should not, say others. Debt, by definition, has to be paid. It is only a way of postponing the pain. While in some cases, this is sensible. If debt grows too large, it stops being a problem for the future and becomes a problem for the present, as interest rates rise and inflation increases. We will soon be due a reckoning we cannot avoid.

Keywords

Magic Money Tree - This was a phrase used by then Prime Minister Theresa May in 2017 to describe the Labour Party's more liberal attitude to public spending. May was likely alluding to a kind of Chinese good luck charm, a decorative tree associated with fortune.

Furlough - This used to be a word for a permitted absence, and refers to the scheme where the government subsidised the wages of those who could not work during the lockdown. The cost of the scheme is estimated at almost 40bn.

Budget deficit - The debt is the total amount of money that the government owes, but the deficit is the difference between how much the government spends and how much it earns.

Fiscal year - This is the accounting year of the government. Fiscal, in this and other contexts refers to tax and spending policies.

G7 - A group made up of six of the world's major industrialised nations/advanced economies (Canada, France, Germany, Italy, Japan, the UK) plus the EU. All of its current members are democracies.

IMF - The international Monetary Fund. Its main function has been to manage debt difficulties in many countries, often enforcing strict financial discipline in exchange for loans to governments.

Gilts - British government bonds have a gilded (gold) edge, and gilts is short for gilt-edged securities.

Crowding out - The theory that government spending crowds out investment operates on the basic principle that government debt increases interest rates, which makes it more costly for private businesses to borrow and invest. Ironically, it was the creation of government bond systems that first created the infrastructure for loans on the kind of terms now found acceptable to private business.

Fear as the Magic Money Tree keeps on giving

Glossary

Magic Money Tree - This was a phrase used by then Prime Minister Theresa May in 2017 to describe the Labour Party's more liberal attitude to public spending. May was likely alluding to a kind of Chinese good luck charm, a decorative tree associated with fortune.

Furlough - This used to be a word for a permitted absence, and refers to the scheme where the government subsidised the wages of those who could not work during the lockdown. The cost of the scheme is estimated at almost 40bn.

Budget deficit - The debt is the total amount of money that the government owes, but the deficit is the difference between how much the government spends and how much it earns.

Fiscal year - This is the accounting year of the government. Fiscal, in this and other contexts refers to tax and spending policies.

G7 - A group made up of six of the world’s major industrialised nations/advanced economies (Canada, France, Germany, Italy, Japan, the UK) plus the EU. All of its current members are democracies.

IMF - The international Monetary Fund. Its main function has been to manage debt difficulties in many countries, often enforcing strict financial discipline in exchange for loans to governments.

Gilts - British government bonds have a gilded (gold) edge, and gilts is short for gilt-edged securities.

Crowding out - The theory that government spending crowds out investment operates on the basic principle that government debt increases interest rates, which makes it more costly for private businesses to borrow and invest. Ironically, it was the creation of government bond systems that first created the infrastructure for loans on the kind of terms now found acceptable to private business.