Is this the end of money? The Bank of England is considering negative interest rates for the very first time in theory this means that the banks could pay you interest to take out a loan.

Bank warns ‘get ready for negative interest’

Is this the end of money? The Bank of England is considering negative interest rates for the very first time in theory this means that the banks could pay you interest to take out a loan.

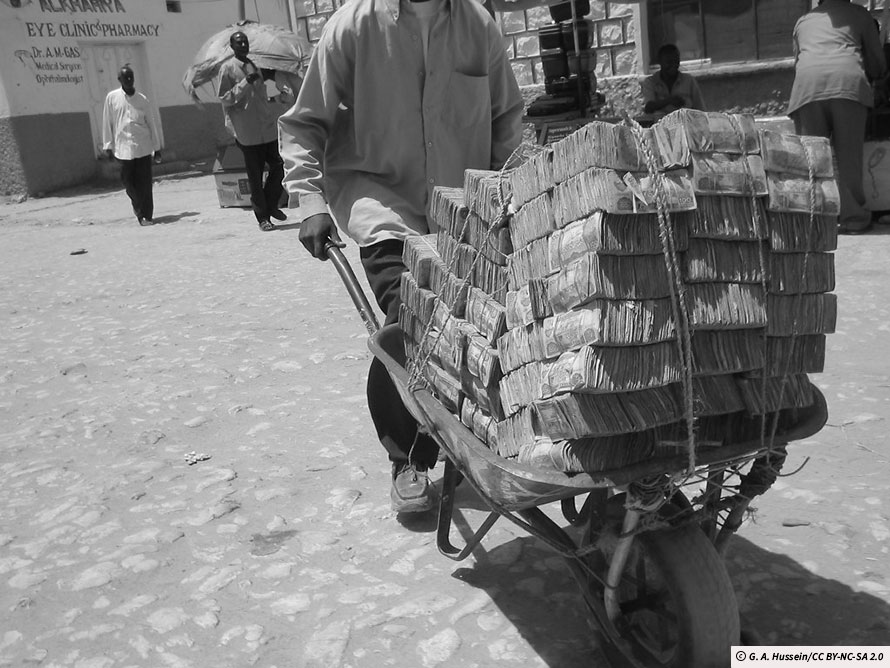

Each morning, Marianne Hove goes to one shop, and her husband goes to another. When they arrive, they ring each other and start comparing prices. They have to move fast: the prices are rising as they speak. She buys the goods that are cheaper in her shop, and he buys whatever is cheaper in his. Then they both rush to the checkout - the prices may have risen again by the time they get there.

Marianne lives in Zimbabwe, where the rate of inflation is currently more than 600%. This is actually a kind of stability: in 2009, it reached 79.6 billion% per month.

Some people are worried that this may soon happen in other countries. They think that currencies all over the world may be near collapse, and that negative interest rates could send them over the edge.

Yesterday the Bank of EnglandThe central bank of the UK. Like other central banks around the world, it tries to stabilise the economy by keeping down inflation and offering loans to struggling banks. suggested that it might lower its interest rate below zero per cent for the first time in its history. This means that you would have to pay the bank to hold your money, and it would pay you to take out a loan.

This would turn the banking system on its head. Normally, customers are paid interest to keep their money in the bank, and charged interest to borrow.

Central banks use interest rates to manage the economy. If rates are high, then people have an incentive to keep their money in the bank because they will make a profit just by leaving it there. If interest rates are low, however, they can make more profit by investing it.

As such, interest rates effectively control the "cost" of money. If rates are high, then money is worth more, and people save it. If they are low, then money is worth less, and people spend it.

This creates a dilemma. If interest rates are below zero, then the cost of money is also effectively negative. Yet money is only valuable if people accept it in exchange for goods and services. For that, everyone must be confident that it will keep its value over time.

Some people believe that negative interest rates could make people lose confidence in money, causing its value to drop sharply.

That could be a disaster if it affects certain key currencies. Economist James Rickard points out that the value of most currencies around the world is linked with the value of the US dollar. If the value of the dollar falls suddenly, then other currencies could collapse, forcing people to resort to a barter system.

Rickard argues that the only way of securing the value of a currency is to link its value with gold: a system known as the "gold standardThe system, abandoned in the Depression of the 1930s, by which the value of a currency was defined in terms of gold.". That way, people maintain confidence in its value.

But others argue that the value of the dollar cannot drop suddenly because the dollar is the international standard of value. If everything is valued in dollars, the dollar's own value cannot change: one dollar is always worth one dollar.

Supporters of negative interest rates point out that they are really nothing new. Switzerland first started using negative rates in the 1970s, while Denmark, Japan, and then EurozoneAll the countries of the European Union that use the euro as their currency. have adopted them more recently.n

<h5 class="eplus-aw7jCn wp-block-heading eplus-wrapper">But could this be the end of money?</h5>

Yes, say some. They argue that central banks have lost control of currencies and the economy. They are worried that the global economy is too precarious, and the whole money system might collapse. Some think that since alternative currencies like BitcoinA virtual currency that is "mined" using computers. Bitcoin was inspired by the idea that currencies' value should not be controlled by central banks. In truth, however, its value has fluctuated much more wildly than that of most centralised currencies. - which are not controlled by central banks - can now be used instead of ordinary money, centralised money systems may become obsolete.

No, say others. Money has always been surprisingly flexible. Before coins and banknotes were widely available, people created their own money simply by exchanging "IOU" slips indicating how much one person owed another. When countries suffer hyperinflationInflation that reaches more than 50% per month. In such conditions, money quickly becomes worthless, and people simply stop using it., they rarely abandon money: either they issue new money, or they just use another country's money, usually the US dollar.

Bank of England - The central bank of the UK. Like other central banks around the world, it tries to stabilise the economy by keeping down inflation and offering loans to struggling banks.

Gold Standard - The system, abandoned in the Depression of the 1930s, by which the value of a currency was defined in terms of gold.

Eurozone - All the countries of the European Union that use the euro as their currency.

Bitcoin - A virtual currency that is "mined" using computers. Bitcoin was inspired by the idea that currencies' value should not be controlled by central banks. In truth, however, its value has fluctuated much more wildly than that of most centralised currencies.

Hyperinflation - Inflation that reaches more than 50% per month. In such conditions, money quickly becomes worthless, and people simply stop using it.

Bank warns ‘get ready for negative interest’

Glossary

Bank of England - The central bank of the UK. Like other central banks around the world, it tries to stabilise the economy by keeping down inflation and offering loans to struggling banks.

Gold Standard - The system, abandoned in the Depression of the 1930s, by which the value of a currency was defined in terms of gold.

Eurozone - All the countries of the European Union that use the euro as their currency.

Bitcoin - A virtual currency that is "mined" using computers. Bitcoin was inspired by the idea that currencies' value should not be controlled by central banks. In truth, however, its value has fluctuated much more wildly than that of most centralised currencies.

Hyperinflation - Inflation that reaches more than 50% per month. In such conditions, money quickly becomes worthless, and people simply stop using it.